Business Auto

Offering coverage for your business from financial costs of an accident to physical damage and more

About Our Business Auto Coverage

From contracting to transportation, your business confronts risk every time an employee is behind the wheel. We understand your business needs, and offer coverages for a wide range of exposures you may encounter including:

- Transportation expenses

- Rental reimbursement

- Hired/non-owned auto

Note: this coverage is not available for auto-related businesses and motor carrier or trucking firms

Interested in Working With Us?

Our team is ready to create your customized insurance solution. Let’s get started.

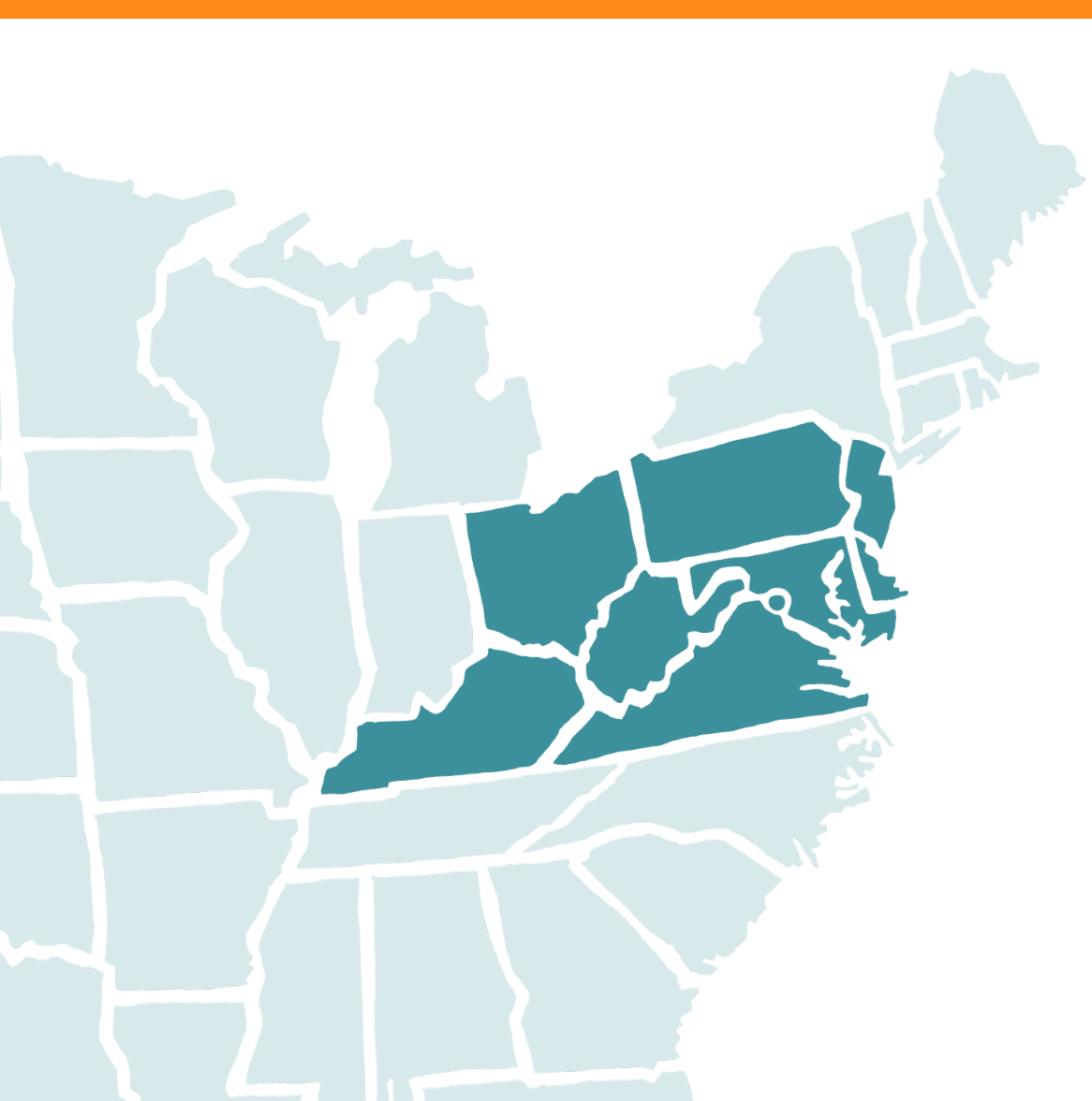

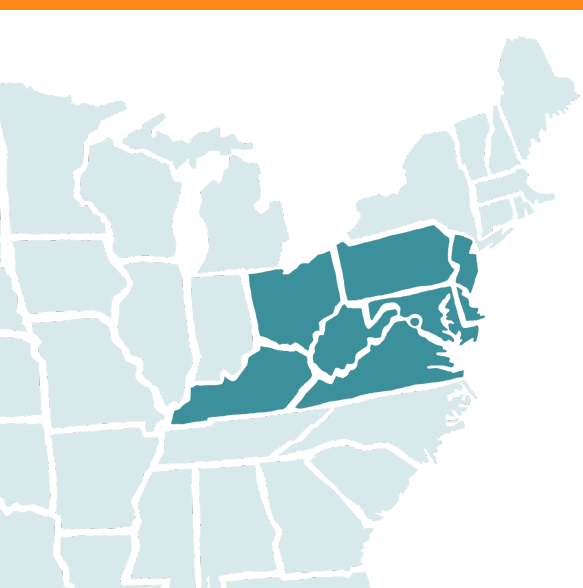

States Served

Our appointed agents cover an eight state region throughout the Mid-Atlantic with four local offices to serve you. We are committed to local accessibility, availability and, above all, responsiveness.

- Delaware

- Kentucky

- Maryland

- New Jersey

- Ohio

- Pennsylvania

- Virginia

- Washington DC

- West Virginia